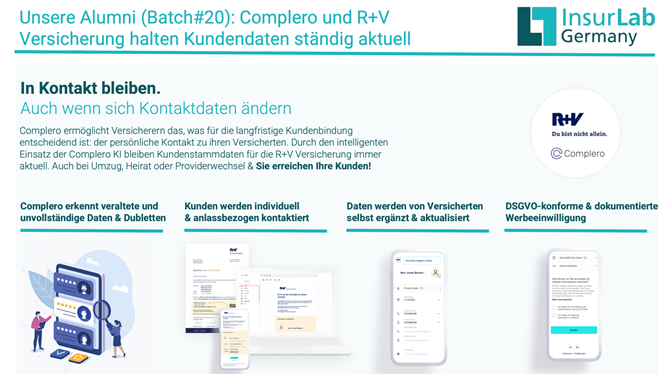

Outdated and altered customer data results in annual revenue losses of around six percent across all industries. In the insurance industry, over 17 % of addresses cannot be reached by post. Regardless of whether it's a move, a marriage or a change of provider: every year, around 20 percent of your existing customers' contact data changes. Through the intelligent use of the Complero platform, customer master data always remains up-to-date, and this within a few weeks through simple integration into your existing system. Updating your data with Complero offers you numerous advantages, including cost reduction through automation and avoidance of potential disruptions, minimization of mail returns & process costs, improved receivables management and new revenue potential through the accessibility of your customers.

Complero was founded in 2017 by Tobias Hamann and Steffen Schneider, who have known each other since childhood and worked together as management consultants. When Tobias Hamann was researching Artificial Intelligence at the German Research Center for Artificial Intelligence (DFKI) in Kaiserslautern and at Prefecture University in Japan, he and his co-founder Steffen Schneider realized that they could apply Artificial Intelligence to contact data to detect when it changes. Over the course of the last few years, their enthusiasm for technology and entrepreneurship led to the creation of a platform where companies and end users can share their contact data and keep it up-to-date. Complero has since been awarded numerous startup prizes and EU funding programs and was already part of InsurLab Accelerator Batch #20 in 2020.

Complero's proprietary AI technology achieves impressive customer results that are proven to be unmatched by any other vendor in the market. The technology is up and running within four weeks of project launch, and Complero handles the entire process and automation. In addition, Complero helps to meet legal requirements and transforms data protection compliance efforts, for example through current advertising opt-ins, into new business opportunities.

Participation in the InsurLab Accelerator Batch #20 led to contact and a temporary cooperation with R+V Versicherung. Through the successful cooperation, hundreds of data are updated and completed daily to maintain personal contact with customers and strengthen customer loyalty. The collaboration to date has improved the quality of the selected data by over 22%. The collaboration has so far provided important insights into both customer responses and potential benefits. For example, savings can be realized in process costs such as mail returns and research efforts. At the same time, the completion of contact data provides an opportunity for service improvement for the insured in the form of a personal approach by R+V.

For more information on how automatic updating of contact data relieves employees, reduces costs and at the same time increases the quality of service, see www.complero.com.